Advantages of Currency Options

Also the listed options are regulated. They may provide increased cost-efficiency They may be less risky than equities They have the potential to.

Free Currency Tips Stock And Nifty Options Tips Commodity Tips Intraday Tips Rupeedesk Shares Day Trading Day Trading Stock Options Trading Trading Charts

The main difference between the two is that in currency options trading their values are determined at a specific time period.

/close-up-of-computer-monitor-946388998-a64b758052274786b2c0a57891cf9fce.jpg)

. Advantages It allows traders to take leverage trades as the premium cost of the option contract is very minimal compared to the actual buying of the contract which enables them to take a large position by paying a nominal premium. A foreign currency option is a contract giving the option purchaser the buyer the right but not the obligation to buy or sell a fixed amount of foreign exchange at a fixed price per unit for a specified time period. They are very cheap to trade They are available on or off exchange Risk is limited to premium if you are a buyer Very high potential returns versus risk Lots of strategies to speculate on volatility and price movement Disadvantages of OTC FX options.

The most basic form of an FX option but still very effective. Advantages of Currency Option Bonds A currency option bond allows investors to hedge against exchange rate risk. The initial fee paid for the options will still have been incurred however.

Advantages of currency options. Only available to companies with large foreign exchange exposures. For example a US.

This is known as a vanilla option. As the controlling element in this market is currency it is considered to be the most liquid in the world which means more influx of cash. Subsidiary could buy a Pound Sterling putUS.

Foreign currency options are available on the. Currency options do not need to be exercised if it is disadvantageous for the holder to do so. Holders of currency options can take advantage of favourable exchange rate movements in the cash market and allow their options to lapse.

Advantages of buying currency options Youre protected from any adverse movements in the exchange rate. This is an advantage to disciplined traders who know how to use leverage. Advantages of Foreign Currency Options A foreign currency option provides two key benefits.

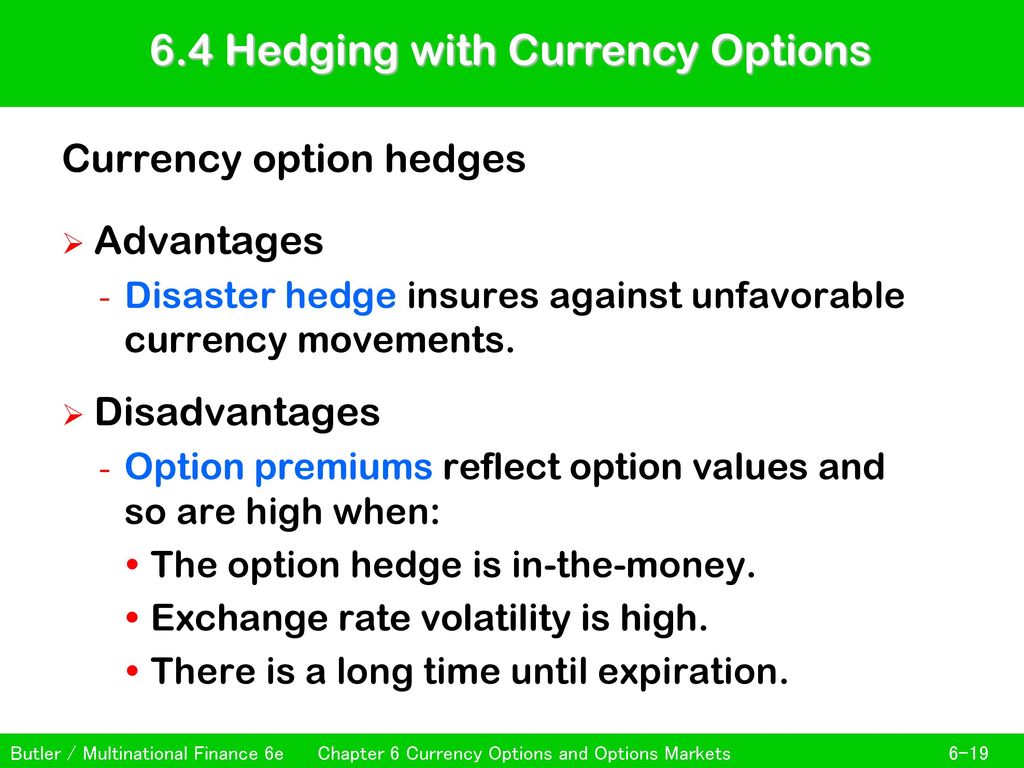

If there is a favourable movement in rates the company will allow the option to lapse to take advantage of the favourable movement. Uses of Currency Options Currency options have enjoyed a growing reputation as helpful tools for hedgers to manage or insure against foreign exchange risk. Advantages of currency options.

5365 Currency options market. This is a big advantage unlike the foreign exchange market that operates 24 hours a day five days a week. Colgate university housing options.

Why does athena disguise herself as mentes. Puri chilka lake tour. First an option can be exercised to hedge the risk of loss while still leaving open the possibility of benefiting from a favorable change in exchange rates.

Options allow you to employ considerable leverage. When you purchase an option to exchange 10000 British pounds for 15000 in a month you will pay a sum that is. We are dealing in Rateaudit Ratecheck Transaction Process Outsourcing forex risk advisory trade finance forex portfolio management import and export change rate or buyers and suppliers credit.

A foreign exchange FX option is a type of contract that gives the buyer the right but not the obligation to buy one currency and sell another at an agreed rate of exchange at a point in the future. Currency options give you the opportunity to engage in relatively large trades while investing little money upfront. Rajesh Kumar in Strategies of Banks and Other Financial Institutions 2014.

High performance business model. A currency option is a right but not an obligation to buy or sell a currency at an exercise price on a future date. Second it can compare with future rate which provide the chance to choose the most benefit.

Some strategies like buying options allows you to have unlimited upside with limited downside. Myforexeye is one of the leading full foreign currency exchange in all over India. Corporation looking to hedge against a possible influx of Pounds Sterling due to a pending sale of a UK.

Summary A currency option refers to a derivative contract that gives the buyer the right but not the obligation to purchase or sell currencies at a given exchange rate and within a specified time frame. Advantages of Forex Options Trading You can delve into the forex market with minimal losses once you invest in Forex Options. Currency options are a tool for hedging foreign exchange risk.

Disadvantages of buying currency options The expense of setting the option up. First an Australian corporation can uses currency options to get right in order to hedge its exposure in euros. There are many advantages of currency options trading 1.

Advantages of using currency options Euros. To compensate for the reduced risk the interest rate on a currency option bond is always lower than the interest rate on any of the single currency bonds that make up the currency option bond. Classement des monnaies les plus faibles en afrique.

Nonprofit resource center. They are useful for investors to hedge against unfavorable movements in exchange rates. How to get sap out of lululemon pants.

An example of a vanilla option is to buy the. There are four key advantages in no particular order options may give an investor. This form of trading coalesce Forex market with Options Trading.

Your business can benefit if the exchange rate moves in your favour.

Pin By Brooke Gillitzer On Finance Trading Trade Finance Forex Trading Forex

No comments for "Advantages of Currency Options"

Post a Comment